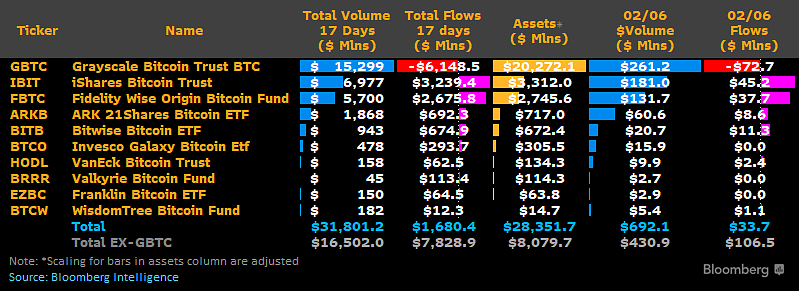

The Bitcoin exchange traded funds (ETFs) have been launched approx. 1 month ago. The launch was a great success: In the first 17 trading days of the ETFs, a commulative trading volume of almost $32bn has ben achived. Almost $29bn have been invested in the Bitcoin ETFs – and are thus the assets under management.

Source: James Seyffart (Bloomberg)

One of the Bitcoin ETF providers, the issuer of FBTC Fidelity, is now starting to include its Bitcoin ETFs in other multi-asset ETFs. In the case of one ETF, they have put 2% of funds of the ETF into FBTC. This is very relevant. It shows that Bitcoin is now also being used as diversification for other ETFs – and is seen as a hedge. If BlackRock, as the world’s largest asset manager, also takes this step, the volume could continue to increase significantly.

Focus on Ethereum ETF

In the meantime, the focus is now more and more shifting Ethereum. Key question: Are ETH ETFs coming soon? The SEC has now received nine applications. The first „final deadline“ is May, 23 2024, i.e. the SEC’s decision can no longer be postponed on this date. In the case of Bitcoin, all ETFs were approved at once on the day of the first „final deadline“. However, the situation with ETH ETFs is not quite as clear. The SEC voted 3:2 in favor of the BTC ETFs – Garry Gensler was the deciding vote. If a similar result on a vote can be expected remains to be seen.